Just my luck that last night just as I pushed the Publish button, I received a copy of Foreign Exchange Agreement #33, regulating the new “market”, different than the Cencoex Bs. 6.3 per US$ system and the Bs. 12+ Sicad system. Then this afternoon I received the regulations for the securities part of SIMADI. In some sense, it is good that it happened this way, otherwise lst night’s post may have been too long, complex and boring.

To give you my punchline right away: SIMADI may be a system, but a market, it ain’t.

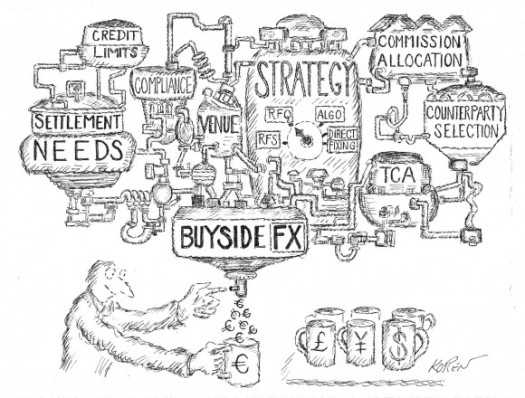

In fact, it an extraordinarily complex and bizarre system for buying and selling currency. It even makes you wonder why it is that way…

SIMADI has three parts:

1) The cash retail system

2) The bank cash system

3) The bank and broker securities system

Let’s look at each of them:

1) The cash retail system

This market called “menudeo” will function via foreign exchange houses and banks and be devoted only to individuals. Minimum is US$ 300 and it will be limited to US$ 300 per day, US$ 2,000 per month and US$ 10,000 per year for each individual,

How does it work? You go to your bank or exchange house and buy or sell dollars at yesterday’s exchange rate for the system. This will also be (yesterday’s rate) the referential rate for credit card transactions and custom duties.

2) The cash bank system

This is likely the weirdest one. Minimum is US$ 3,000. You also buy at yesterday’s rate, however, each bank can only buy and sell foreign currency with its own clients. That is, there is no interbank system or market. You buy and sell only with the clients of your bank and at yesterday’s price. To make it even weirder, banks can not hold positions. That is they can not buy dollars for their own account in this system, only by buying (selling) cash from clients and selling (buying) cash to other ones. If they buy too much on a given day, they have to sell any excess foreign currency to the Venezuelan Central Bank. Oh yeah! If you are a client and want to do either, you have to send the bank either the Bolívars or the US$ to the bank ahead of time. Only if they are there is the bank allowed to do the transaction.

3) The securities system

The securities system will operate in the Bolivarian Stock Exchange, where all authorized brokers and banks can operate. They can buy or sell dollar denominated securities in exchange for Bolivars at an agreed rate.

However, they can not do transactions with anyone but their clients and other brokers and banks can not be your client. i.e. You have the sellers you can find buyers among your clients. That’s it. When you sell the bonds in US$, the dollars from the transaction have to go to your Venezuelan banking system dollar based account.

In this market, brokers and banks can take positions, i.e. they can buy, for example, dollars from a client, keep it and later sell it to another client, but not to another broker or bank.

Oh yeah! The Central Bank does have to approve the transactions you close.

Thus, this is no market. This is just a bizarre system. Why do you need to do this via an exchange is a mystery, except that the Government wants to keep tabs of transactions, but there are no bids or asks, the clients of your institution (to use the language of the regulations) agree on a price and you do the transaction at that price. But you don’t talk to other market players. You only look at previous transactions and try to have your clients agree on a price.

What does this mean?

-The price has a strange way of being constructed.

-There is no market per se

-If you are a bank or a broker, you can only sell however many dollars your own clients sell to you.

-I suspect that Government-owned banks will have a huge advantage as the Government, the largest generator, provider, holder of foreign currency, will likely give its own banks bonds or foreign currency to trade. They will have a gigantic advantage over private banks. Once again, leave the private sector out of it as much as possible, maybe the word “marginal” refers to the role of the private sector in all this.

-The parallel market still exists. Moreover, there will be arbitrage now not only between Cencoex and Sicad and the parallel rate, but there will also be arbitrage between SIMADI and the parallel rate. And a privileged few will make a lot of easy money.

-Market it is not, just a bizarre and complex system to exchange foreign currency.

Par for the course from Chavismo…