Venezuelans love a conspiracy theory. Sometimes it seems it is easier to embrace such theories than to analyze what is going on. Least of all, look at numbers to seek a possible explanation. This week was a clear example of that. As the parallel exchange rate soared, the most common explanation was that a webpage was manipulating the price of the dollar for some obscure or maybe not so obscure purpose.

That webpage claims to obtain its price from whatever its happening at the border of Venezuela with Colombia. These are real transactions. The exchange houses in Cucuta open in the morning and begin trying to make a market adjusting the price according to what they see. I have no clue as to the volume traded in Cucuta every day, but the border has a very active trade and there has to be a way of going back and forth between Bolívars and US$ or Pesos. This is what that webpage supposedly reports.

Of course, that particular webpage has a lot of influence, as it seems to be the one most people check. But let’s look at the variables that affect the exchange rate and what’s been happening in the last few months.

At the origin of everything, is oil. The Venezuelan oil basket determines how any dollars come in every day to the country, whether you believe the country’s production is X or Y, variations in the price of oil affect the cash flow the Government sees. And that determines everything. When the Government had savings and cash lots of cash flow, it would divert some money to the parallel exchange, whether before it became illegal in 2010, after that or in the last few months. The problem is that savings are gone, the Government owes everyone money and it has so little foreign currency that in March it created a new and newfangled foreign exchange system with three official rates (Bs. 6.3 per US$, Sicad and Simadi) and the second one, Sicad, has yet to have an auction. It is only used as a reference according to the last value it had prior to the new system being announced.

That’s how little money the Government has.

This is what the Venezuelan oil basket has done in the last six months:  As you can see, the price hit bottom at $38.82 per barrel the week of January 31st and has recovered to US$ 56.28 per barrel by now. However, most oil sold by Venezuelan is sold on a 90 day basis, so that the Government is receiving today is that of 90 days ago, or roughly February 20th., which was around US$ 47 per barrel. Thus, cash flow has improved in the last three weeks (In theory the minimum was around April 30th), however, the lower cash flow has taken a huge toll on the savings (International reserves):

As you can see, the price hit bottom at $38.82 per barrel the week of January 31st and has recovered to US$ 56.28 per barrel by now. However, most oil sold by Venezuelan is sold on a 90 day basis, so that the Government is receiving today is that of 90 days ago, or roughly February 20th., which was around US$ 47 per barrel. Thus, cash flow has improved in the last three weeks (In theory the minimum was around April 30th), however, the lower cash flow has taken a huge toll on the savings (International reserves):  Reserves began the year at US$ 22 billion, grew to over US$ 24 billion in March and since then, they have dropped to barely US$ 17 billion. That’s a 22.7% drop since January, thanks to the Dominican Republic buying out its Petrocaribe debt and down 29.16% since the beginning of March.

Reserves began the year at US$ 22 billion, grew to over US$ 24 billion in March and since then, they have dropped to barely US$ 17 billion. That’s a 22.7% drop since January, thanks to the Dominican Republic buying out its Petrocaribe debt and down 29.16% since the beginning of March.

Not a pretty picture.

At that level, liquid international reserves are likely around US$ 500 million at most, which is peanuts for a country the size of Venezuela. And with shortages all over the place and the Government owing money to everyone (A Brazilian delegation of food exporters came to Venezuela a week ago, they left empty handed) there is simply little money for the parallel market.

Thus, as demand soars (companies have to function), supply collapses.

Guess what happens then?

Moreover, some of the supply disappeared as the jailing of a couple of Venezuelans in the US has apparently scared some suppliers of the market.

If goods are scarce in Venezuela, then the greenback seems to be the the toughest good to find.

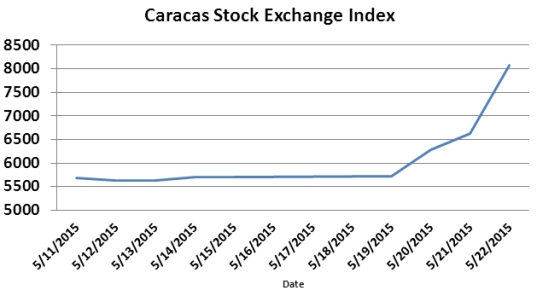

And if you think that the dollar market price is artificial and there is little volume in that market, let me show you a graph of another market: The Caracas Stock Exchange. Volume in this market is very low, some $50k-$100k per day. Why? Because there are very few shares to be had. Well, this week, as the parallel exchange rate soared 31%, the Caracas Stock Index soared even more, jumping up 42% for the same reason:  Simply put, there are very few stocks sold and people were looking to protect their savings, just like those seeking to buy foreign currency are trying to either protect their savings or keep their enterprises going.

Simply put, there are very few stocks sold and people were looking to protect their savings, just like those seeking to buy foreign currency are trying to either protect their savings or keep their enterprises going.

And you can’t blame any webpage for the fact that stocks soared even more (close to 25% more!) than the actual rate of exchange. And there is some real trading in that market…

The point is that what is going on is simply the effect of scarcity. The Government has fewer dollars at a time that it has run down its savings.

And to make matters even worse, the Venezuelan Central Bank keeps printing Bolívars like there is no tomorrow, as shown by this plot of how M2, the Money Supply, has increased since last year:

As you can see, as the price of oil collapsed (fewer dollars), the Money Supply, the number of Bolívars in circulation (which can buy dollars) almost doubled and the savings are practically gone. This means that there are almost twice as many Bolívars chasing those very scarce dollars, local stocks and/or goods.

Simply, a recipe for disaster… So, don’t blame a webpage or a conspiracy…blame reality.