Venezuelans love a conspiracy theory. Sometimes it seems it is easier to embrace such theories than to analyze what is going on. Least of all, look at numbers to seek a possible explanation. This week was a clear example of that. As the parallel exchange rate soared, the most common explanation was that a webpage was manipulating the price of the dollar for some obscure or maybe not so obscure purpose.

That webpage claims to obtain its price from whatever its happening at the border of Venezuela with Colombia. These are real transactions. The exchange houses in Cucuta open in the morning and begin trying to make a market adjusting the price according to what they see. I have no clue as to the volume traded in Cucuta every day, but the border has a very active trade and there has to be a way of going back and forth between Bolívars and US$ or Pesos. This is what that webpage supposedly reports.

Of course, that particular webpage has a lot of influence, as it seems to be the one most people check. But let’s look at the variables that affect the exchange rate and what’s been happening in the last few months.

At the origin of everything, is oil. The Venezuelan oil basket determines how any dollars come in every day to the country, whether you believe the country’s production is X or Y, variations in the price of oil affect the cash flow the Government sees. And that determines everything. When the Government had savings and cash lots of cash flow, it would divert some money to the parallel exchange, whether before it became illegal in 2010, after that or in the last few months. The problem is that savings are gone, the Government owes everyone money and it has so little foreign currency that in March it created a new and newfangled foreign exchange system with three official rates (Bs. 6.3 per US$, Sicad and Simadi) and the second one, Sicad, has yet to have an auction. It is only used as a reference according to the last value it had prior to the new system being announced.

That’s how little money the Government has.

This is what the Venezuelan oil basket has done in the last six months:  As you can see, the price hit bottom at $38.82 per barrel the week of January 31st and has recovered to US$ 56.28 per barrel by now. However, most oil sold by Venezuelan is sold on a 90 day basis, so that the Government is receiving today is that of 90 days ago, or roughly February 20th., which was around US$ 47 per barrel. Thus, cash flow has improved in the last three weeks (In theory the minimum was around April 30th), however, the lower cash flow has taken a huge toll on the savings (International reserves):

As you can see, the price hit bottom at $38.82 per barrel the week of January 31st and has recovered to US$ 56.28 per barrel by now. However, most oil sold by Venezuelan is sold on a 90 day basis, so that the Government is receiving today is that of 90 days ago, or roughly February 20th., which was around US$ 47 per barrel. Thus, cash flow has improved in the last three weeks (In theory the minimum was around April 30th), however, the lower cash flow has taken a huge toll on the savings (International reserves):  Reserves began the year at US$ 22 billion, grew to over US$ 24 billion in March and since then, they have dropped to barely US$ 17 billion. That’s a 22.7% drop since January, thanks to the Dominican Republic buying out its Petrocaribe debt and down 29.16% since the beginning of March.

Reserves began the year at US$ 22 billion, grew to over US$ 24 billion in March and since then, they have dropped to barely US$ 17 billion. That’s a 22.7% drop since January, thanks to the Dominican Republic buying out its Petrocaribe debt and down 29.16% since the beginning of March.

Not a pretty picture.

At that level, liquid international reserves are likely around US$ 500 million at most, which is peanuts for a country the size of Venezuela. And with shortages all over the place and the Government owing money to everyone (A Brazilian delegation of food exporters came to Venezuela a week ago, they left empty handed) there is simply little money for the parallel market.

Thus, as demand soars (companies have to function), supply collapses.

Guess what happens then?

Moreover, some of the supply disappeared as the jailing of a couple of Venezuelans in the US has apparently scared some suppliers of the market.

If goods are scarce in Venezuela, then the greenback seems to be the the toughest good to find.

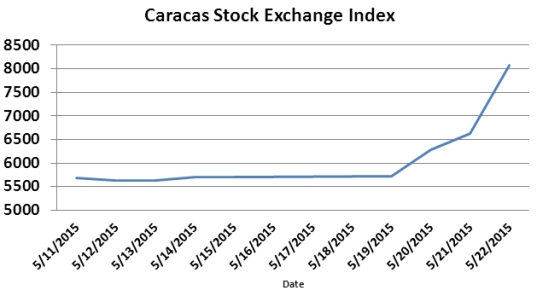

And if you think that the dollar market price is artificial and there is little volume in that market, let me show you a graph of another market: The Caracas Stock Exchange. Volume in this market is very low, some $50k-$100k per day. Why? Because there are very few shares to be had. Well, this week, as the parallel exchange rate soared 31%, the Caracas Stock Index soared even more, jumping up 42% for the same reason:  Simply put, there are very few stocks sold and people were looking to protect their savings, just like those seeking to buy foreign currency are trying to either protect their savings or keep their enterprises going.

Simply put, there are very few stocks sold and people were looking to protect their savings, just like those seeking to buy foreign currency are trying to either protect their savings or keep their enterprises going.

And you can’t blame any webpage for the fact that stocks soared even more (close to 25% more!) than the actual rate of exchange. And there is some real trading in that market…

The point is that what is going on is simply the effect of scarcity. The Government has fewer dollars at a time that it has run down its savings.

And to make matters even worse, the Venezuelan Central Bank keeps printing Bolívars like there is no tomorrow, as shown by this plot of how M2, the Money Supply, has increased since last year:

As you can see, as the price of oil collapsed (fewer dollars), the Money Supply, the number of Bolívars in circulation (which can buy dollars) almost doubled and the savings are practically gone. This means that there are almost twice as many Bolívars chasing those very scarce dollars, local stocks and/or goods.

Simply, a recipe for disaster… So, don’t blame a webpage or a conspiracy…blame reality.

May 26, 2015 at 6:22 pm

Por fin COMPRARON MI FOTO!!! .estuve en excellente compañia..se vendieron obras de Lat Am alguna por mas dr $1mm !

May 26, 2015 at 9:25 am

[…] Parallel Rate Soars: Whose Fault Is It? […]

May 26, 2015 at 9:03 am

The French aristocracy lost their heads when France ran out of bread.

May 28, 2015 at 8:35 am

The Chavista aristocracy doesn’t have any brains in their heads, so chopping their heads off won’t really kill them.

You have to chop their asses off.

May 26, 2015 at 9:00 am

Businesses quietly switch to dollar in socialist Venezuela.

http://news.yahoo.com/businesses-quietly-switch-dollar-socialist-venezuela-040219420.html

May 26, 2015 at 7:44 am

The Empire Strikes Back!

Dollar hits one-month high as periphery woes weigh on Europe.

http://finance.yahoo.com/news/dollar-hits-one-month-high-092004123.html

May 26, 2015 at 8:10 am

Yes, and as the Dollar strengthens on world markets, a gradual collapse in the oil price will follow. Foreign currency traders in the oil markets will slowly pull-away. On top of that ‘oilprice.com’ points out that the fundamentals for oil supply and demand are still out of balance. They say oil prices will be forced down over the coming months. Bad news for those hoping for an oil price rebound. T’aint gonna happen.

http://oilprice.com/Energy/Oil-Prices/Oil-Markets-Cant-Ignore-The-Fundamentals-Forever.html

May 26, 2015 at 9:01 am

Oil drops to $65 on U.S. shale outlook, dollar

http://finance.yahoo.com/news/oil-prices-steady-indications-rally-013551998.html

May 26, 2015 at 12:53 am

Is the website DólarToday? I read I think in Noticias24 which reports all the pro-government nonsense that the Governor of Tachira wanted to shut it down.

May 26, 2015 at 7:36 am

The website is indeed dolartoday.

Just do a Google search.

The government has been trying to shut them down for yeats and has their main url blocked from inside Venezuela.

This hasn’t prevented them from getting out through the use of proxies, disquised urls & social media.

Just follow them on FB or Twitter for all the latest information.

May 25, 2015 at 4:38 pm

The government has a monopoly on petrodollars since they own the oil (it says so in the constitution). Since they are the sole suppliers, if they hoard the dollars the dollar rises. Supply and Demand 101.

May 25, 2015 at 12:22 pm

Anybody seen that gold lately? Venezuela is a place where gold turns to lead! Just like oil, import prices are set by the world market. Don’t like it, don’t import. At this point I bet people line up to buy mangos

May 25, 2015 at 12:13 pm

But how long will people continue to believe the government’s lies? What are they willing to tolerate before they face the reality that their revolution is a bust?

May 25, 2015 at 10:56 am

And, and when the foreign reserves plunge even further than what is in the bank today, there is always the, ….gold! Yup. “Hey, you guys! ..Lend us a couple of billion and, as collateral, we’ll set-aside some of this gold bullion in OUR vaults. OK? Huh? What? What, you don’t trust us? But the gold is right here in the central bank, in our vaults, in plain sight. OK? Got it? There it is! See it? So, how much ya gonna lend us? Look, have we stiff’d anyone lately? I mean, lately. Forget about … Airlines? old news. Auto makers? their problem, not ours. Panama? canal rates are way too high. Odebrecht? we can’t trust the Brasilians. So, c’mon, lend us the money. Trust us. Just look at all that gold!”

May 25, 2015 at 7:57 am

The higher the dollar, the more inflation, the more escasez, the longer the lines, the angrier people will get. Great news!

May 25, 2015 at 7:08 am

IT IS THE HYPERIONFLATION STUPID!!

Octavio, everything has a beginning, and in Venezuela could be oil,. sometimes, not always, however, once you are in the roll coaster of hyperinflation, everything is depending on prices, so in the beginning are the prices, as well as in the end, The ongoing discussion on hyperinflation is silly, most economists loos the time looking for the zeros they do not see, most like to quote Cogan, a 50 year old paper because they do not see the zeros, in other words in order, for several of them, there is not hyperinflation if they do not see the zeros, That is a way back to give the rights to BCV and the government for the way the misuse the statistics and make up it in order to give the impression of lower inflation than it really impact. Let me give an example. A “canasta basica” a measure on consumption of several vital goods and services, used by CENDA from more than 30 years. in Jan 2013, a canasta basica could be acquired for 1.2 salaries minimos,, Jan 2015, 24 months after, a canasta basica is acquired by 6.4salarios minimos, that is, about 5 times more, or 500% without adding inflation from Jan to April which adds 45% -non official yet, It means that the underlying hyperinflation is already at 250% monthly. Your know better than me that parallel $ is made of thousand arbitrages, and that’s is very important regarding the price of the dollar, the perception of buyers and sellers in a market where even you buy the amount you want, you have to pay some transactions costs in order to legitimate some of these transactions, both in dollars and in bolivars; so on top of the real “price” the is a risk premium um we have to pay anyway. What it is the amount of that risk premium? I do not mind, I just need the dollar whatever the use I will give them.

I will not add other particular tansactiosn which takes place on the b orders, narco, wash and wash, gasoline, smuggling, but I do remember the owner of the dollars running in the official forez is the government, the same wich order printey money the dast the BCV can!. Ambas puntas en las mismas manos!, You see it,,,,who are the “speculators”. to use a very nice word not to name the “prices descoverers”

May 25, 2015 at 6:42 am

Your diagnostic is dead on Miguel, the website is just the “messenger.” Sadly poverty rules in Venezuela. From the very low income families that believe in Chavismo as a way to pull out of misery to the poor judgment of the Maduro Government.

May 25, 2015 at 6:24 am

Kudos, Excelet post Devil, .Cosnpiracy theorist are sugesting in web pages that the cause of the run on the Bs is chavista money finfing refuge before a crisis with godviven at the center.

May 25, 2015 at 5:49 am

If you have time to read have a look at: La economia Politica de como se arbitra la hiperinflaciojn: http://www.alexanderguerrero.com/muestras.php?id=340#

May 25, 2015 at 3:25 am

You kill all the fun Miguel! Conspiracy theories are so much fun!

However I do think that for once some in the regime are pushing for that rise as a way to get dollars to finance their electoral campaign. After all, they have not much left in their arsenal than direct cash payments to their operators…. a few well placed rumors and we jump for a couple of weeks to 400. Well, I hope so if not we are in deeper trouble than even pessimists like myself thought we were.